Series 7 Exam Question 96: Answer and Explanation

Question: 96

An investor buys 1 XYZ May 60 put for 6 and writes 1 XYZ May 50 put for 2. What is the investor's maximum potential gain?

- A. $200

- B. $400

- C. $600

- D. Unlimited

Correct Answer: C

Explanation:

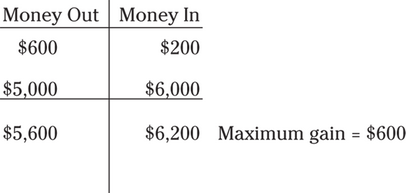

C. This is a spread because the investor bought a put and sold a put. It is also a debit spread because they paid more for the option they purchased than they received for the option sold. The easiest way to figure out the maximum gain would be to set up an options chart. See the setup below:

The investor purchased the 60 put for $600 (6 × 100 shares per option), so you have to put the $600 on the money out portion of the chart. Next, the investor sold the 50 put option for $200 (2 × 100 shares per option), so you have to put that in the money in portion of the chart. Stop at this point to see if that gives you the answer you need. Because you have more money out, that tells you that the maximum potential loss is $400 ($600 out – $200 in). Since you're looking for the maximum potential gain, you have to exercise both options. Put $6,000 (60 put × 100 shares per option) on the Money In side of the chart because puts switch, meaning that when you exercise a put, it goes on the opposite side of the chart from its premium. Next, put $5,000 (50 put × 100 shares per option) on the Money Out side of the chart. Total up the two sides, and you'll see that the investor has $6,200 in and $5,600 out, which gives the investor a maximum potential gain of $600 ($6,200 in – $5,600 loss).

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12