Series 7 Exam Question 95: Answer and Explanation

Question: 95

An investor is long 1 ABC Oct 50 call at 9 and short 1 ABC Oct 60 call at 3. Which TWO of the following are TRUE?

I. The break-even point is 56

II. The break-even point is 62

III. The maximum potential gain is $400

IV. The maximum potential gain is unlimited

- A. I and III

- B. I and IV

- C. II and III

- D. II and IV

Correct Answer: A

Explanation:

A. This is a debit call spread. We know it's a debit spread because the investor paid more for the option purchased than they received for the option sold. To find the break-even point, begin by finding the difference between the two premiums because you had one buy and one sell:

adjusted premium = 9 - 3 = 6

This is a call spread; therefore, you have to add the 6 to the lower strike price. The lower strike price is 50, so the break-even point is 56:

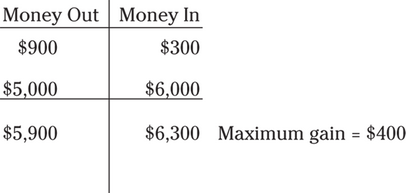

To determine the maximum potential gain, set up an options chart:

First, put the premiums in the options chart. The investor bought the option for $900 (9 × 100 shares per option) in the Money Out side of the chart. Then, put the $300 for the option sold in the Money Out side of the chart. At this point, you can see that the maximum potential loss is $600 ($900 out – $300 in). So, you have to exercise both options to get the maximum gain. Because you are dealing with call options, the exercised strike prices must go underneath their premiums because calls same. So, place the $5,000 (50 strike price × 100 shares per option) in the Money Out side of the chart. Then, place the $6,000 in the Money In side of the chart. Total up the two sides, and you'll see you have $400 more in than out, so that's the maximum potential gain.

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12