Series 7 Exam Question 92: Answer and Explanation

Question: 92

Which TWO of the following are TRUE regarding an investor who sold short 100 shares of DDD common stock at 35 and purchased 1 DDD Oct 40 call at 3?

I. The maximum potential gain is $3,200

II. The maximum potential gain is $3,800

III. The maximum potential loss is $200

IV. The maximum potential loss is $800

- A. I and III

- B. I and IV

- C. II and III

- D. II and IV

Correct Answer: B

Explanation:

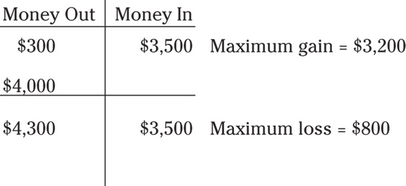

B. I would suggest that you set up an options chart to answer this question so that you're less likely to make mistake. Check out the following setup:

The first thing to do is to put the stock and option in the chart. The investor sold the stock short for $3,500 (35 × 100 shares), so you have to put that in the Money In side of the chart. Next, the investor purchased the option for $300 (3 × 100 shares per option), so you have to put $300 in the Money Out side of the chart. At this point, stop and take a look and you'll see that you got one answer. Since there is $3,200 more in than out ($3,500 in – $300 out), the maximum potential gain is $3,200. To get the maximum potential loss, exercise the option. It's a 40 call option, so you have to put $4,000 (40 × 100 shares per option) under its premium because calls same (the exercised call goes on the same side of the chart as its premium). Total up the two sides and you'll see that there is $800 ($4,300 - $3,500) more money out than money in, so that's your maximum potential loss.

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12