Series 7 Exam Question 260: Answer and Explanation

Question: 260

Ginny Gemms purchased 2 LMN 50 calls and paid a premium of 3 for each option. Ginny also purchased 2 LMN 50 puts and paid a premium of 2 for each option. At the time of purchase, LMN was trading at $50.25. Just prior to expiration, LMN was trading at $44.50, and Ginny decided to close her options for their intrinsic value. Excluding commission, Ginny had a

- A. $50 profit

- B. $50 loss

- C. $100 profit

- D. $100 loss

Correct Answer: C

Explanation:

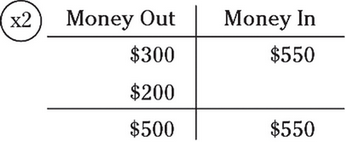

C. The easiest way for you to see what's going on is to set up an options chart. Ginny purchased 2 calls and 2 puts, so the first thing you should do is put the multiplier of "× 2" on the outside of the chart; this way, it's as if you're dealing with single options. Because she bought the calls for 300 each (3 × 100 shares per option) and the puts for 200 each (2 × 100 shares per option), you need to put "300" and "200" in the "Money Out" side of the chart. Next, Ginny closed her options for their intrinsic value (the in-the-money amount). Because put options go in-the-money when the price of the stock goes below the strike price, just the put option is in-the-money, not the call option. With the strike price at $44.50 and the strike price at 50, the put is 5.50 in-the-money ($50.00 - $44.50). So, you need to put $550 in the "Money In" side of the chart because Ginny closed the option (to close means to do the opposite — if you originally bought, you have to sell to close). Total up the two sides and you see that Ginny had a profit of $50 per option. Because Ginny bought 2 options, she had a profit of $100.

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12