Series 7 Exam Question 251: Answer and Explanation

Question: 251

A customer buys 1 DUD Jun 55 put at 4.50 when DUD is trading at 53.40. Just prior to expiration, the option is trading at 4.55 bid-4.65 asked. If the customer closes their position with a market order, what is the gain or loss?

- A. $5 gain

- B. $5 loss

- C. $160 gain

- D. $160 loss

Correct Answer: A

Explanation:

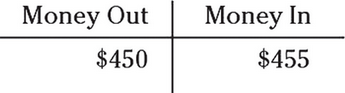

A. Although you may not need an options chart to figure out the answer to this one, creating a chart is good practice, and I think it lessens your chances of making mistakes. First, because the customer purchased the option for 4.50, you need to place $450 (4.50 × 100 shares per option) in the "Money Out" portion of the chart. Next, you have to close the option for 4.55 because you buy at the ask price and sell at the bid price. To close the option, the customer has to do the opposite of what they did originally; if they originally bought the option, as they did here, to close, they have to sell. So, you need to put $455 in the "Money In" side of the chart. Now, you can see that the customer had a $5 gain because they received $455 for selling the option and paid $450 for buying the option.

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12