Series 7 Exam Question 236: Answer and Explanation

Question: 236

One of your customers purchases 100 shares of ARGH at 44.10 and 1 OEX Sep 360 put at 4.50. A few months later, ARGH is trading at 42.55 and the OEX index is trading at 349. If your customer closes the stock position and exercises their OEX put, what is their gain?

- A. $155

- B. $495

- C. $1,100

- D. $35,395

Correct Answer: B

Explanation:

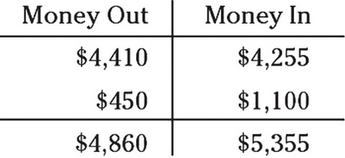

B. The easiest way for you to see what's going on is to set up an options chart. Your customer purchased 100 shares of ARGH at 44.10, so you have to put $4,410 (44.10 × 100 shares) in the "Money Out" side of the chart. Next, your customer purchased an OEX put for 4.50, so you have to put $450 (4.50 × 100 shares per option) in the "Money Out" side of the chart. If your customer closes the stock position (to close means to do the opposite … if they originally bought, to close, they have to sell) for 42.55, you have to put $4,255 (42.55 stock price × 100 shares) in the "Money In" side of the chart. Then, because you're dealing with an option that settles in cash instead of delivery of the underlying security, you need to put the profit of $1,100 in the "Money In" side of the chart. To get the $1,100, you have to remember that put options go in-the-money when the price of the stock goes below the strike price, which it is by 11 (360 - 349), and options are for 100 shares. Total up the two sides, and you see that your customer has a profit of $495.

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12