Series 7 Exam Question 221: Answer and Explanation

Question: 221

If a client has a margin account with $18,000 in securities and a debit balance of $7,000, and Regulation T is 50 percent, which of the following statements is FALSE?

- A. The account has a buying power of $4,000.

- B. If the client withdraws any excess equity, the debit balance decreases by the amount of the withdrawal.

- C. The account has excess equity of $2,000.

- D. The securities held in the account most likely increased in value.

Correct Answer: B

Explanation:

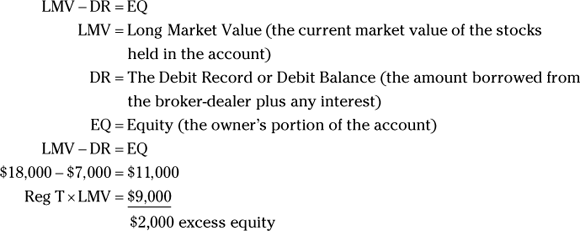

B. Because this margin account has a debit balance, it's a long account; short accounts have a credit balance. The easiest way to deal with margin questions of this type is to set up a long margin account formula:

Because the LMV equals $18,000 and the DR equals $7,000, the EQ has to be $11,000. From there, you have to compare what the investor should have in equity to be at 50 percent (Regulation T) of the LMV with what is actually in equity. With Regulation T at 50 percent, which is standard, the investor should have $9,000 in EQ to be at 50 percent. However, because the investor has $11,000 in equity, the excess equity is $2,000.

Because the account has excess equity (SMA), it has buying power. Remember, it is SMA/RT to use your buying power, which tells you that you need to divide the SMA by Regulation T to determine the buying power:

SMA/RT = SMA / Regulation T = $2,000 / 50% = $4,000

Long accounts like this one generate excess equity by the securities held in the account increasing in value.

If the investor withdraws the excess equity, they're essentially borrowing more money from the account and the debit balance increases, not decreases.

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12