Series 7 Exam Question 217: Answer and Explanation

Question: 217

A registered representative executes the following trades for a speculative investor:

I. Buy 1 GHI May 30 call at 8

II. Sell 1 GHI May 35 call at 3

III. Are these trades suitable for this investor?

- A. It is impossible to tell with the information given.

- B. Probably not, because the risk is not high enough for a speculative investor.

- C. Yes, buying and selling options are always appropriate for speculative investors.

- D. No, because it is impossible to make a profit with these positions.

Correct Answer: D

Explanation:

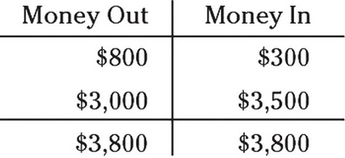

D. These trades aren't suitable for any investor because it's impossible for the investor to make a profit. I've set up an options chart to demonstrate to you how this is so. First, put the premiums for the options in the chart. Because the investor bought the May 30 call option at 8, you have to put $800 (8 premium × 100 shares per option) in the "Money Out" side of the chart. Next, put $300 (3 premium × 100 shares per option) in the "Money In" side of the chart because the investor sold that option. Because the investor has $800 out and $300 in, you know that the investor's maximum loss potential is $500 ($800 - $300). To get the maximum gain, you have to exercise both options. Because "calls same," you have to put the exercised strike prices below their respective premiums in the chart. Place $3,000 (30 strike price × 100 shares per option) under its premium of $800 and place $3,500 (35 strike price × 100 shares per option) under its premium of $300. After that, you have to total the sides to see that because the "Money In" side and the "Money Out" side of the chart each equal $3,800, there's no way the investor can make a profit.

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12