Series 7 Exam Question 191: Answer and Explanation

Question: 191

Mrs. Smith purchases 100 shares of ABC at 35 and writes a 40 call at 5.50. If ABC stock increases to 60 and the call is exercised, Mrs. Smith has a

- A. $2,500 gain

- B. $3,050 loss

- C. $2,000 loss

- D. $1,050 gain

Correct Answer: D

Explanation:

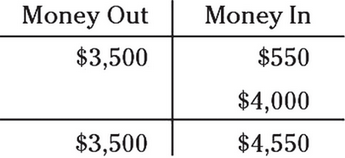

D. As with the previous question, the easiest way for you to see what's going on is to set up an options chart. Mrs. Smith purchased 100 shares of ABC at 35, so you have to put $3,500 (35 × 100 shares) in the "Money Out" side of the chart. Next, Mrs. Smith wrote (sold) an ABC call for 5.50, so you have to put $550 (5.50 × 100 shares per option) in the "Money In" side of the chart. After the stock increased, the call was exercised, so you have to put the exercised strike price of $4,000 (40 strike price × 100 shares per option) under its premium of $550 because "calls same," meaning that for call options, the premium and the exercised strike price go on the same side of the chart. Total up the two sides and you see that Mrs. Smith had a gain of $1,050.

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12