Series 7 Exam Question 182: Answer and Explanation

Question: 182

Mr. T. Jefferson bought ten municipal bonds at 105 with ten years to maturity. Three years later, he sold the bonds for 102. His tax consequence is a

- A. $150 gain

- B. $150 loss

- C. $300 gain

- D. $300 loss

Correct Answer: B

Explanation:

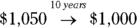

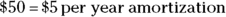

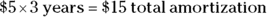

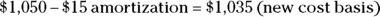

B. I recommend that you set up the equation as if you're dealing with one bond and then multiply the answer by 10 at the end. Mr. Jefferson purchased the bonds at $1,050 (105 percent of 1,000 par) and the bonds are maturing at $1,000 par. So, as far as the IRS is concerned, Mr. Jefferson is losing $5 per year ($50 loss divided by 10 years) on the value of a bond. Because he sold the bonds in three years, the total amount of amortization per bond would be $15. After subtracting the $15 from the $1,050 purchase price, you see that the new cost basis is $1,035. After three years, Mr. Jefferson should sell the bonds for $1,035 each to break even. Because the bonds were sold for $1,020 (102 percent of 1,000 par), he had a loss of $15 per bond. Because Mr. Jefferson had 10 bonds, he had a capital loss of $150.

Test Information

- Use your browser's back button to return to your test results.

- Do more Series 7 Exam Practice Tests tests.

More Tests

- Series 7 Exam Practice Test 1

- Series 7 Exam Practice Test 2

- Series 7 Exam Practice Test 3

- Series 7 Exam Practice Test 4

- Series 7 Exam Practice Test 5

- Series 7 Exam Practice Test 6

- Series 7 Exam Practice Test 7

- Series 7 Exam Practice Test 8

- Series 7 Exam Practice Test 9

- Series 7 Exam Practice Test 10

- Series 7 Exam Practice Test 11

- Series 7 Exam Practice Test 12